AI is the new Cold War

How the U.S. and China turned Artificial Intelligence into world’s most dangerous arms race

In the spring of 2016, Google DeepMind showcased a new form of technology, Alphago, that recognizes patterns and makes its own strategic decisions through the notorious Chinese Go game, which overwhelms players with an astronomically greater number of possible board positions and strategic possibilities compared to chess. The whole world gasped as artificial intelligence mastered complex strategies and defeated a series of world champions, including the then-world champion Go player, Lee Sedol. The following year, Ke Jie, one of the world’s top-ranked Go players at the time, acknowledged that “the future belongs to AI.”

Since then, the narrative of Artificial Intelligence development has been written mainly by the US. Backed by US$302 billion in massive investments — six times the Chinese government’s funding of approximately US$51 billion — the US has pulled decisively ahead. Notably, the United States’ monopoly on the cutting-edge chips, led by Nvidia’s Blackwell Graphics Processing Unit, has enabled the training of the most capable generative AI models and put the US at the forefront of a human-like Artificial General Intelligence (AGI) race. Like any frontrunner, the United States has grappled to guard its classified technologies, restrict access to key resources, and block rivals from closing in.

However, China’s covert actions to avoid export controls and access US proprietary AI technology were not aborted. Despite President Biden’s “Safe, Secure, and Trustworthy Development and Use of Artificial Intelligence” executive order, between 2024 and 2025, various cases of theft of US technologies alerted the White House. The Department of Justice found that a Chinese Google employee “allegedly uploaded more than 500 unique files containing confidential information” about Google’s supercomputing data centers. The Wall Street Journal reported that China rerouted imports of AI chips, disguising them as third-party regions. “China continues to employ illegal means such as economic espionage and cyber data exfiltration to target U.S. technologies like high-performance computing, pharmaceuticals, and aerospace sectors,” said the US Trade Representative. CNN also reported that China lashed out at the US and the UK’s accusation of Chinese espionage as “Western allies’ move on act of ‘political manipulation.’”

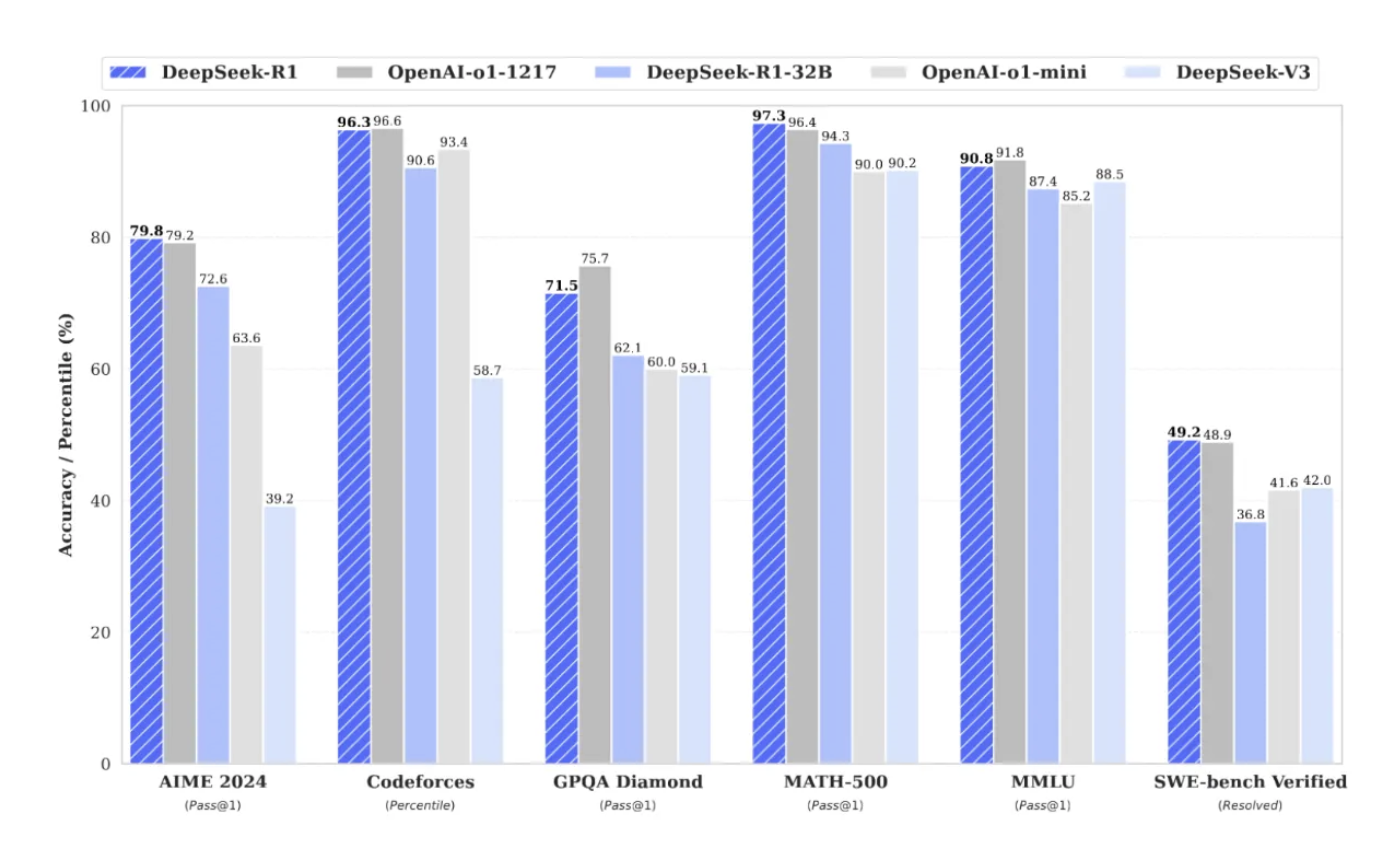

The launch of Deepseek R1 on January 20, 2025, sent the most alarming wakeup call to the US government and its European allies. Upon its launch, DeepSeek, the open-source large language model from China, outperformed ChatGPT, the heavily invested, closed-source private model. According to the Openxcell report, it costs 95 percent less than OpenAI and its competitors. For developers, DeepSeek’s model is 82 percent cheaper than ChatGPT’s when used for accessing AI models for software development. While using only 10 percent of ChatGPT’s resources, DeepSeek was also performing at the same level or better than ChatGPT. William Robertson Coe, a Stanford Human-Centered Artificial Intelligence (HAI) Senior Fellow, commented on DeepSeek to be “less expensive, less compute-hungry, less environmentally insulting.”

China’s unexpected breakthrough has now escalated a once-tacit rivalry into an open AI Cold War, intensifying the already fierce technology race between the United States and China to a new level. For too many, Deepseek marked “AI’s Sputnik moment,” as venture capitalist Marc Andreessen commented on X. Washington and Beijing are now bracing for a head-to-head in a full-scale tech showdown.

Washington first revived its discussions about whether to expand administrative, legal, and economic measures, including tighter export controls, much stricter trade sanctions, high tariffs, and investment restrictions, to curb China’s momentum while protecting the US intellectual property. Altering approaches to governance and international relations to lead this technological race in the exponentially growing field of generative technologies is the most viable option.

The US also alleged that China’s chase did not seem to be possible without the US precedent. The House Select Committee on the Chinese Communist Party announced on April 16, 2025, that Deepseek employed “unlawful distillation techniques” that misappropriated proprietary elements from leading U.S. companies. Rolling out hard-line measures, the US slapped a 100 percent tariff on Chinese electric-vehicle imports, 25 percent duties on lithium-ion EV batteries, and 50 percent levies on Chinese-made semiconductors and solar cells from 2025 onward. Further blockade of US technology flow to China seemed inevitable.

Accordingly, the Trump administration tightened export controls on competitors and third countries implicated in chip smuggling and fueling China’s race for advanced semiconductors. The revelation that TSMC had illicitly manufactured millions of AI chips for Huawei prompted Washington to further toughen its export controls. The Commerce Department also issued guidance cautioning against Chinese AI chips and the misuse of American ones to train Chinese models. Furthermore, No Adversarial Act was passed to block Chinese AI systems from all US federal agencies and to bar American firms from trading or collaborating with Chinese AI companies or their regional partners.

Known as Apple’s forever competitor, Intel lost an entire decade after its transition to M-series processors. After Paul Otellini retired in 2013, the board struggled to find a leader who understood both engineering and the business sides. Eventually, they promoted Brian Krzanich. Krzanich was a manufacturing expert who reportedly created a “toxic” and “siloed” internal culture. He missed the mobile revolution entirely and oversaw major delays that allowed AMD and TSMC to dominate the market. In 2018. He was forced to resign following a prior allegation against an employee. His successor, Bob Swan (former CFO), was seen as a placeholder who lacked the technical vision to lead a “technology” company. It took bringing back Pat Gelsinger in 2021 — who had left years prior as an engineer — to stop the decline.

Performance Comparison between DeepSeek and OpenAI’s Models

While US export controls have restricted China’s access to patented American products, they have also driven Beijing to boost its own capacity. Morgan Stanley reported China’s AI chip self-sufficiency rate stood at 34 percent in 2024, which is further projected to expand to 82 percent by 2027. Trade sanctions are expected to accelerate Huawei’s development, enabling Chinese AI to compete with NVIDIA in the domestic market.

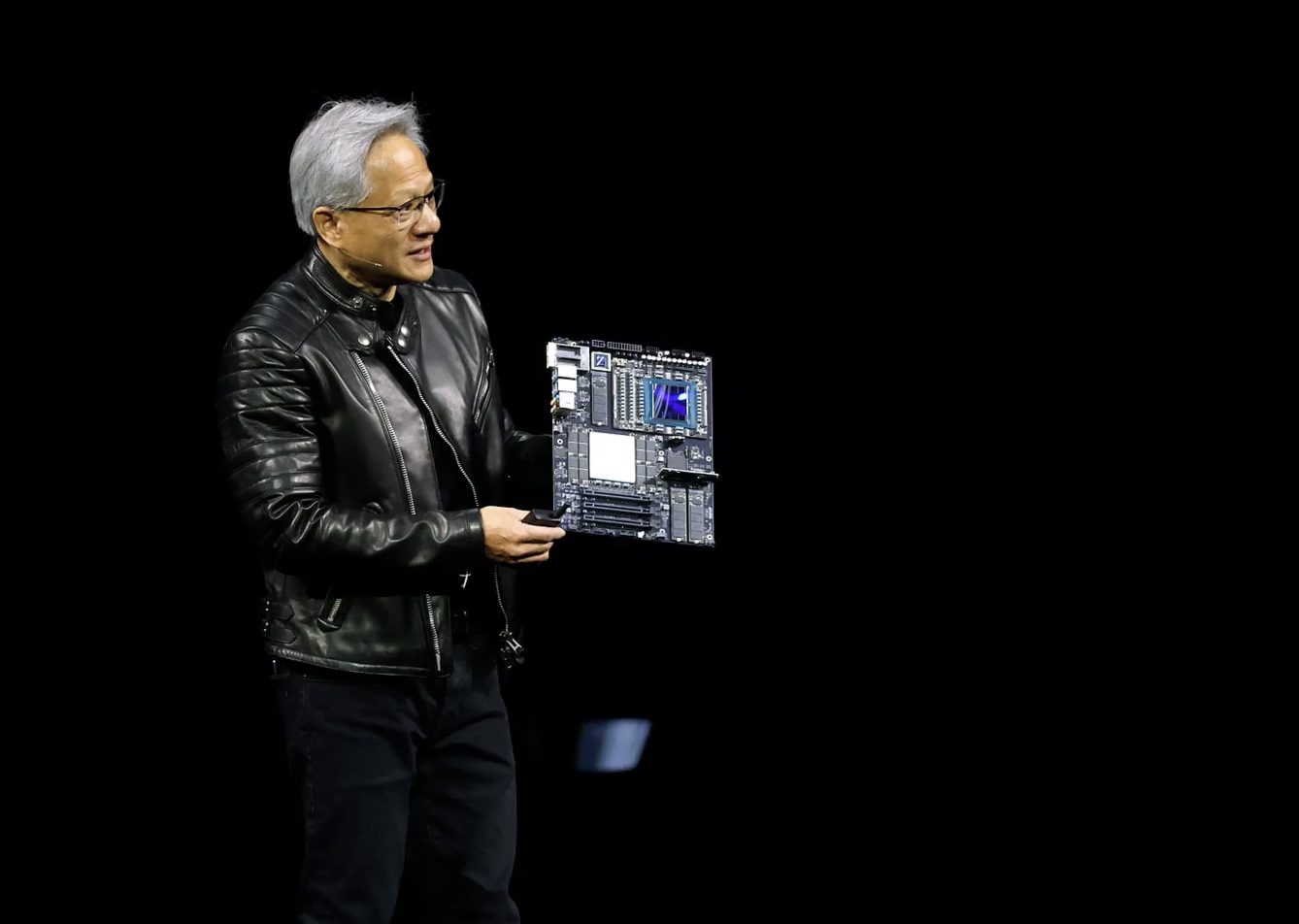

Moreover, excluding the Chinese market from their profit forecasts due to the strict guidelines, tech companies like Nvidia “missed out on an additional $2.5 billion in revenue” from losing out on selling China its H20 AI chips — the core technology for Chinese AI development. Jensen Huang, the CEO of NVIDIA, argued on CNBC that the Chinese competitor’s market could reach US$50 billion, resulting in a significant loss for the US. Huang also emphasized that if the United States leaves the market, it would create an opportunity for Huawei to catch up, paving the way for Chinese native development of essential GPU technology.

Source: NPR

Eventually, on July 14th, 2025, the US Government allowed Nvidia to resume sales of the less advanced H20 chips to China in order to maintain Beijing’s dependence on American GPUs. The decision followed months of pressure from industry leaders who warned President Trump that an outright ban would risk ceding the world’s second-largest market to Chinese rivals. Especially for Nvidia, the change recovered billions in lost revenue. Washington, at the same time, made a successful, calculated compromise by restoring America’s commercial leverage while maintaining a controlled technological lead over Chinese competitors.

The geopolitical struggles are an endless loop of rivalry. The unpredictable AI landscape shows that the current race is not simply about innovation, but about dominance without an ultimate winner, yet. Meanwhile, the US trade controls have deepened the tensions among countries rather than resolved them, as rising AI powers seek to carve out their influence in this shifting landscape. The uncertainty in the AI war is reminiscent of James P. Carse’s “Finite and Infinite Games” in that the contest has no fixed endpoint — rules change, players rotate, and the finish line turns elusive. Like the United States and China, the regulatory frameworks and the metrics of success frequently change in line with shifting strategic interests and the unpredictable, evolving trajectory of AI itself.

Originally Published in Medium